As 2023 draws to a close, it's time to take stock for the strategy consulting sector. It's been an eventful year, with highs and lows, to say the least. 2023 is taking place in a complex macroeconomic environment, following the exceptional post-covid-19 rebound. Many economic experts predicted a recession this year, but it never came. This uncertain climate has led to a significant wait-and-see attitude on the part of corporate decision-makers. The rise in key interest rates by central banks to counter inflation only reinforced the feeling that now was not the right time to invest in new projects. As a result, fewer strategy consulting assignments, less staffing and fewer new hires. It's a blow that's being felt everywhere, and contrasts with the euphoria of the recovery. But the outlook for 2023 is not all doom and gloom, as there are new prospects for development, notably in the new field of artificial intelligence.

In this article, discover our in-depth analysis of the year 2023 for strategy consulting, with a mixed picture between loss of business and new prospects.

A difficult economic context has led to a decline in missions

Macroeconomic environment: geopolitics, inflation, rising rates, recession?

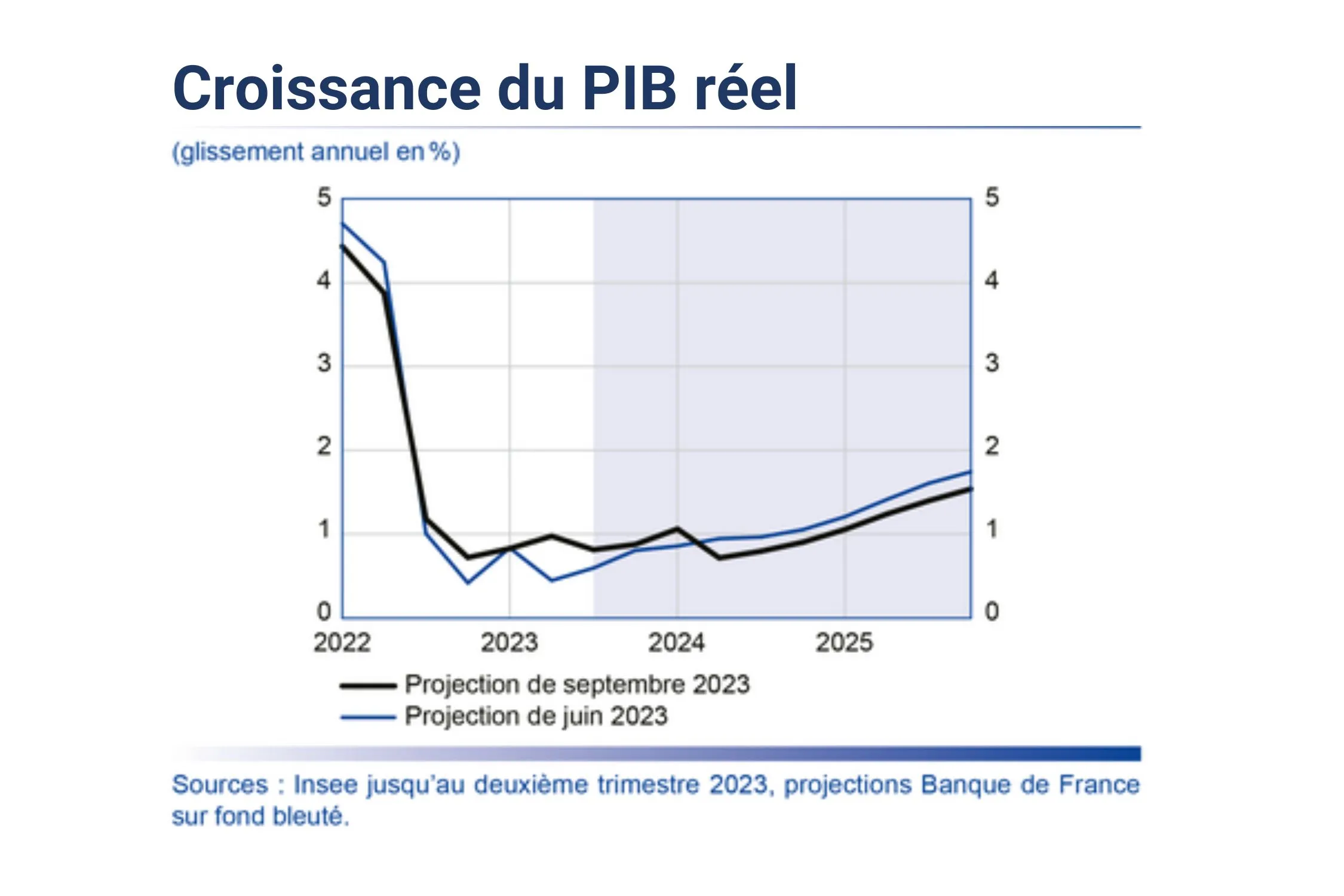

Strategy consulting firms are at the heart of the global economy. When the economy works, the firms work, and conversely, when it slows down, the firms slow down too. The year 2023 is full of contrasts on the macroeconomic front, with central banks tightening their monetary policies on the one hand, and stock markets performing exceptionally well on the other: +23% for the S&P500 and +19% for the Eurostoxx50 since January 1, 2023. And yet, economic growth in the world's main regions remains very weak, at around +0.8% for GDP in France. How should we interpret this information?

First, it's important to review the facts chronologically. The covid-19 crisis brought economic activity around the world to a dramatic halt. In fact, the recovery was all the stronger for it, with economic and fiscal stimulus from governments and businesses boosting demand and accentuating inflationary pressure. Then, in February 2022, Russia started a war in Ukraine, which caused a sharp rise in commodity prices. All these factors combined to trigger a sudden rise in inflation, reaching +6% in France from mid-2022 to early 2023. In the United States, inflation even reached a 40-year high of +9.1% in June 2022. Central banks had to react to counter this inflation by raising key interest rates. The ECB therefore decided to raise rates from 0% to 2.5% between July and December 2022, and then to continue to do so progressively throughout 2023 to reach 4%. The same applies to the FED. High interest rates have a significant impact on economic activity, weakening financial structures, reducing investment and raising fears of recession. Large companies, which are major consumers of strategy consulting services, naturally cut back on assignments. The impact was brutal for the firms.

Secondly, as far as stock markets are concerned, it's important to stress that they don't necessarily reflect economic reality, especially for strategy consulting firms. The markets held up well thanks to strong performances in the industrial and luxury sectors. On the contrary, the end of 2023 was even marked by a fall in inflation and a halt to the rise in key interest rates. The prospect of a rate cut in 2024 without having to go through a recession has boosted market performance. But that doesn't mean that business is all settled for strategy consulting firms.

See also: What is strategy consulting?

Decline in demand for strategy consulting assignments

Demand for strategy consulting assignments has therefore fallen as a result of the macroeconomic environment. This is particularly true for the major strategy consulting firms. In this wait-and-see period, marked by a drop in investment and the withdrawal of new projects, companies have been reluctant to free up budgets for strategy consulting assignments. And rightly so: the big firms like McKinsey, BCG and Bain are expensive. Companies have preferred to concentrate on their current activities, preserve cash and consolidate their business units, so as to be ready for any more difficult times. In addition, the 2021 and 2022 business outlook for strategy consulting firms was marked by a significant increase in private equity and M&A assignments. However, the high interest-rate environment has had a major impact on the sector. The cost of capital has risen considerably, company valuations have fallen, access to financing has become very difficult, the profitability of investments is no longer assured, and market risks are as great as ever. In short, with private equity and M&A, strategy consulting has also lost an essential growth driver.

Welcome to La Plage!

The impact of the drop in assignments in 2023 for strategy consulting firms has been felt directly on consultant staffing. Staffing rates for strategy consultants have dropped considerably, almost everywhere. In an article in Consultor, Gaëlle Zinkiewicz of CVA reported a drop in staffing to around 50% in 2023, compared with over 100% in 2021 and 2022. These figures are more or less the same for other strategy consulting firms in Paris. As a result, non-staffed consultants find themselves "On the Beach" or "à la Plage", depending on the firm. This expression refers to the period during which consultants are not working on an assignment for a client. In times of normal activity, the Beach allows you to take a breather between two assignments. For example, you've just spent an intense 2 months working on a strategic plan for a rail company, and your next project is a due diligence for a consumer goods company for 5 weeks, which promises to be very intense. This new project doesn't start for 1 week, so you're placed "On the Beach" for a breather, with nothing to do. On the other hand, in times of low activity and few staff, being "On the Beach" means that you're working on the firm's internal subjects, most often on sales proposals. The problem with the Beach, particularly for new consultants, is that it's not valued and therefore represents a kind of wasted time. Another problem is that the fewer assignments there are, the less staffing there is, the more Beach there is, and above all, the more Beach there is for new entrants. In fact, if you join McKinsey as a Junior Associate and the staffing rate is very low, you run the risk of starting with a Beach, because above you, there are Junior Associates who have been there for 1 year and who are therefore trained and more interesting for the Partners.

See also: All you need to know about strategy consulting

The year 2023 therefore marks a major stopping point for strategy consulting firms, with a decline in assignments, a drop in staffing and an increase in Beach periods. Unfortunately, everything is linked, and recruitment has also been impacted.

Slow recruitment of MBBs, from top 6 to Tier 3 firms

Recruitment in the strategy consulting industry used to be better!

Flashback to 2021 and 2022, when covid-19 came out, and strategy consulting firms were recruiting in droves to keep up with the surge in assignments. Order books were full, and a lot of new recruits were needed to keep up with the growing number of assignments. A major catch-up effect, particularly at the lower end of the pyramid, which has benefited many school leavers. The acceleration in recruitment due to this urgent need has had several consequences:

- Speeding up recruitment processes

- The aim is not to let the best talent leave for competitors.

- Remote interviewing via videoconferencing

- The 1st rounds are usually done remotely, then the final rounds in person.

- Increase in internship pay

- Internship salaries in all firms have risen above €1,500, reaching up to €2,000 in the best firms.

- Increase in CDI wages

- Entry packages have risen to an average of €60K for the firms and up to €70K for McKinsey, BCG and Bain.

- Improving working conditions

- Introduction of teleworking and new measures to promote a good work-life balance.

Another phenomenon was the faster-than-expected broadening of the target schools, with more students than before from EM Lyon, Sciences Po and Dauphine joining the top firms. EDHEC has also placed a few students in some of the smaller firms. And the more specialized engineering schools, such as Supaéro, have also been a major source of new consultants. Other types of students, notably AST, who have not attended preparatory classes, have on average been more successful in joining firms than before. Unfortunately, by 2023, almost everything has been reversed.

Read also: 10 things you need to know before applying for a job in Strategy Consulting

Slowdown in recruitment: drop in permanent contracts and postponement of internships

Let's go back to where we left off at the beginning of this article: an uncertain environment, a drop in the number of assignments, a very low staffing rate - in short, the situation has become more complicated in 2023 for strategy consulting firms. As a result, recruitment has slowed considerably. The number of open-ended contracts has fallen sharply compared with the previous two years, when firms recruited unusually heavily. On the contrary, the decline in staffing levels is prompting firms to cut back sharply or even freeze recruitment of juniors. But that's not all, as the situation has not improved as we approach the end of 2023, some firms are now terminating probationary periods and no longer converting end-of-study internships to the same extent. "We don't have consolidated data yet, but all the firms are telling us: there's a slowdown after a totally euphoric period of talent shortage", David Mahé told Consultor in an article dated October 2023.

Another problem with recruitment is the low turnover due to the closure of job opportunities. Historically, strategy consulting was seen as a 3rd training cycle for consultants who, after 3 to 4 years on average, left the firm to join a company, a start-up or create an entrepreneurial project. This used to enable consultants to progress rapidly within the firm, with continuous recruitment to junior positions. However, if there are bottlenecks at the end of the chain, then there's a blockage everywhere. More and more consultants are staying with the firm for lack of interesting job opportunities, so progress is slower and juniors pile up, reducing the need for recruitment.

Lastly, the decline in the number of permanent contracts and internships has had a major impact on recruitment processes, mechanically increasing firms' selectivity.

Increased selectivity in strategy consulting recruitment processes

The 2023 recruitment process is almost the exact opposite of 2021 and 2022. There are fewer vacancies, but just as many applications. For example, McKinsey receives 1 million applications worldwide and 12,000 in France every year, according to Clarisse Magnin, Director of McKinsey France, who spoke about these figures on the Alexandre Mars podcast. What impact does this have on recruitment processes?

- Longer time between application and appointment

- You need to apply 6 to 9 months before the desired start date, which roughly corresponds to the recruitment calendar for investment banks. If you want to start in September 2024, you need to apply in January 2023.

- Recruitment processes take longer, as there are many applications to process but few places available. From the 1st HR contact to the last interview, it takes 1 to 2 months on average, if not sometimes more, up to 3 months.

- Increased selectivity in candidate screening

- Back to an extensive CV-based selection process, with priority given to students from a Tier 1 target school: HEC, ESSEC, ESCP, Polytechnique, Les Mines, Les Ponts, Centrale Supélec.

- Importance of post-bac academic career: preparatory class in France or prestigious university abroad.

- Increasing the number of tests in recruitment processes

- Online tests before or after screening to continue to filter and retain the best students: McKinsey, BCG, Bain, Roland Berger, Advancy, EY-Parthenon, Monitor Deloitte, etc.

- Online case study tests, such as BCG's recruitment process.

- Increase the number of rounds from 3 to 5, with 1 or 2 interviews per round.

- Increased interview selectivity

- Case study: need to be impeccable on the case, whereas before one or two mistakes could pass if they were caught.

- Fit: increasingly important to differentiate candidates, some firms even have interviews dedicated to fit, like Bain and Kéa.

- Overall increase in competition between candidates

- Mechanically, the main firms are recruiting less, especially the MBBs, so students are moving on to Tier 2 or Tier 3 firms, which again increases demand for these firms and the competition.

- In fact, these less prestigious firms take on profiles from top business schools such as HEC, ESSEC and ESCP.

See also: Passing the strategy consulting case study test

So 2023 is clearly not a good year in terms of recruitment for candidates, who will have to be satisfied with a smaller firm or alternative experience before trying their luck again later. But 2023 is not all doom and gloom, as new topics are on the table, notably Artificial Intelligence.

The development of artificial intelligence, the new sinews of war in strategy consulting

The AI challenge in strategy consulting firms

On November 30, 2022, ChatGpt was made available to the general public. From that moment on, artificial intelligence became the technology of the future and a vital business issue for strategy consulting firms. Although firms didn't wait until the end of 2022 to discover AI, it's clear that the year 2023 marked a sudden development of this theme in the strategy consulting sector. The aim is firstly to train consultants to use AI internally on assignments, and secondly to be able to deploy AI with clients.

To this end, a number of training courses are offered for junior profiles at firms such as McKinsey, BCG and Bain. When new recruits arrive, they now have bootcamp sessions on artificial intelligence. BCG has gone even further, offering a new 9-week test course for some of its consultants to deepen their AI knowledge and become almost AI experts. The rise of AI has thus accelerated the training of strategy consultants in its use much faster than expected.

How do strategy consultants use artificial intelligence on a day-to-day basis?

AI enables consultants to save a considerable amount of time, with higher productivity in everything from data processing and document synthesis to the production of slides and reports. From analysis to production, artificial intelligence is becoming a key asset for strategy consultants. It used to take a consultant up to a full day to analyze a new market and decipher its main elements, before tackling the customer's problem. Today, with AI, it takes a few minutes or a few hours at most. AI makes it possible to bring together all the firm's knowledge. In short, it facilitates Knowledge Management, which is the primary area of use for artificial intelligence by strategy consulting firms. In the longer term, consultants will use AI to write slides, organize workshops and come up with innovative new ideas.

Between external growth and internal development of firms' AI tools

To gain even greater expertise in the field of artificial intelligence, strategy consulting firms have relied on the Data Science and Data Analytics divisions that most of them had already launched to deal with digital transformation issues: Quantum Black for McKinsey, BCG X for BCG, Advanced Analytics for Bain and PMP Strategy's Data Lab. In addition to these divisions, firms with substantial financial resources have made acquisitions. For example, in January 2023, McKinsey acquired Iguazio, an Israeli startup specializing in AI, which was integrated into Quantum Black. In July 2023, Bain acquired Max Kelsen, a specialist in AI and Machine Learning. The development of consultants and the contribution of new specialists in the field of artificial intelligence enables firms to respond rapidly to clients' needs on this subject. But it also enables consultants to train faster.

The best firms have also equipped themselves with their own AI tools, as in the case of McKinsey, which has announced the launch of Lilli in August 2023. Lilli brings together all the knowledge of the firm and its employees to support consultants in their search for information and contact with experts. According to Adi Pradhan, Associate Partner at McKinsey, Lilli can boost productivity on basic tasks by up to 20% on average. EY has also launched its EY.IA tool at group level for all business lines and EY-Parthenon consultants. Other firms rely on existing artificial intelligences, integrated internally to respect data confidentiality. For example, PMP Strategy uses ChatGpt and provides its consultants with instructions on how to make the most of Sam Altman's AI.

Strategy consulting firms are aiming to turn tomorrow's strategy consultants into artificial intelligence-enhanced consultants. History is in the making, a story to be followed...

See also: The role of strategy consulting in sustainability and CSR

Season's greetings from Strategy Consulting 2024

Well, let's be honest, strategy consulting has had a difficult 2023, and we don't wish it the same problems for 2024. Let's hope that the economic slowdown subsides and that assignments come back, giving a breath of fresh air to consultants in firms and to recruitment. As for artificial intelligence, it's a safe bet that this subject will remain central in 2024, and that firms will put the necessary resources into developing it. Finally, although we haven't mentioned it in this review, let's also hope that CSR/ESG issues continue to develop, as they have for some years now. See you in a year's time for the 2024 review.

Would you like to join the top strategy consulting firms in 2024?

Then join us and be part of the 90% of our candidates who integrate a TOP 6 every year. Prépa Strat is the No. 1 interview preparation program for strategy consulting firms, with :

- 7 years of expertise, we're the oldest player in strategy consulting interview preparation

- 6 bootcamps a year with 35 hours of training over 5 days

- 1 dedicated coach from an MBB for each supported candidate

- 6 online training modules to prepare you for interviews and understand what Strategy Consulting is all about

- 50+ corrected case studies that have already fallen into the hands of top strategy consulting firms

Aim for excellence and join the top strategy consulting firms with PrepaStrat!

Discover our bootcampour real-life interviews and our e-learning platform !