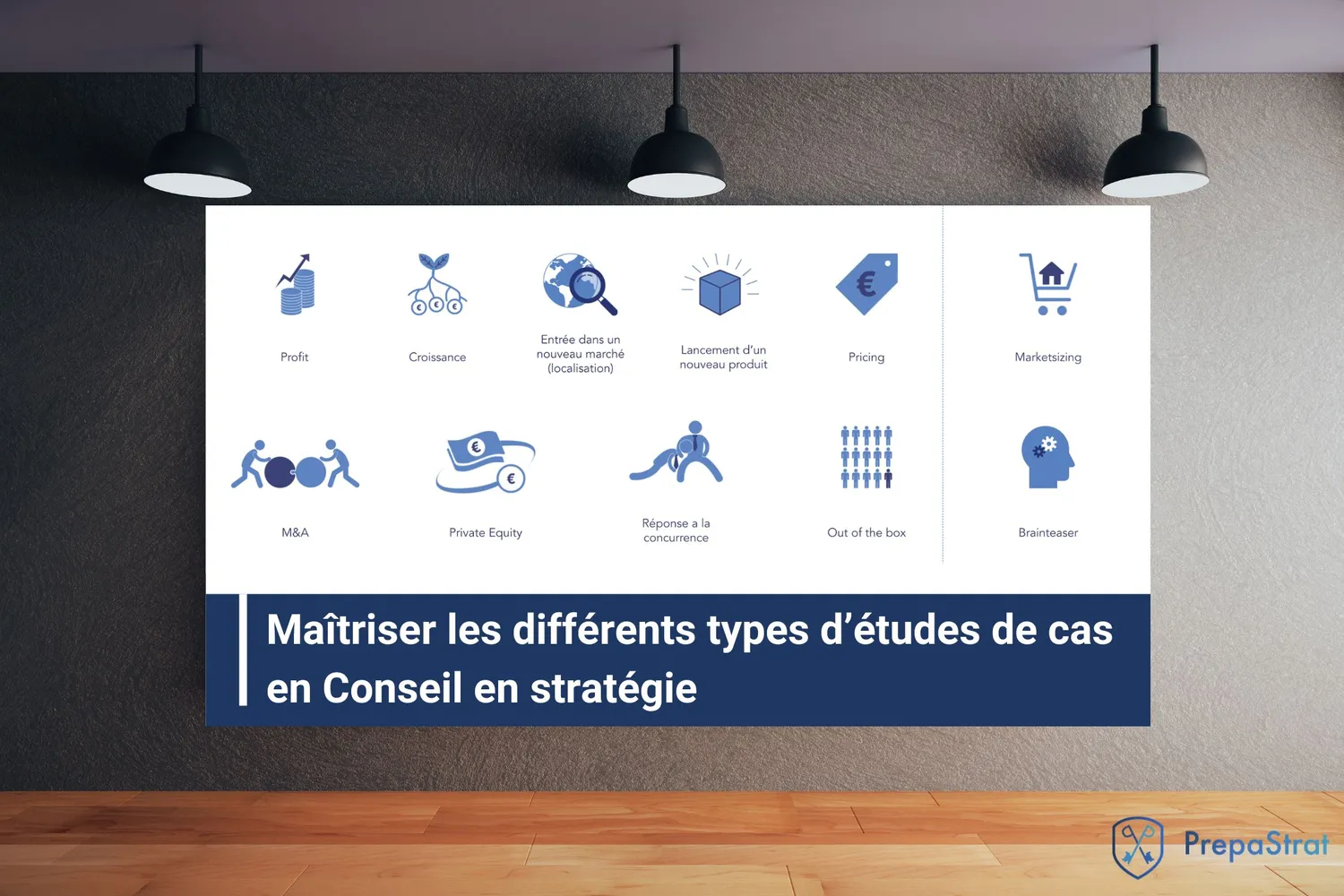

The case study is the most dreaded test for candidates at strategy consulting interviews, not least because there are an infinite number of possible cases. You'll never be able to prepare every case study, but you do need to master the most common types. There are two families of case studies: business and market. Business case studies are often assignments that have been carried out by the interviewer or the firm, while market studies aim to evaluate market sizes or company sales figures. For top strategy consultancies like McKinsey, BCG and Bain, you'll need to not only master these case studies, but exceed them.

Discover in this article the main types of case studies you need to know and master to join the best strategy consulting firms.

Business case studies from strategy consulting assignments

Business case studies require a great deal of preparation, because a case can be relevant to any sector or business line. Even if you have a well-established business culture, you'll need a lot of practice to get up to speed. These case studies are divided into several families, each following a well-defined approach.

See also: Passing the strategic consulting case study test

Profit case studies: a classic in strategy consulting interviews

This is a situation where companies are in financial difficulty and can't work out what the problem is, or what the solutions are. Since they can't solve the problem internally, and are heading straight for bankruptcy, they need your help. No problem, it's the favorite case study of strategy consulting firms, and paradoxically the easiest business problem to tackle. The approach structure for this type of case study is often the same, because it's so logical.

- Identify where this profit problem comes from, either revenues or costs.

- Find solutions to this problem by analyzing revenues and costs in depth.

Example - Bain case study Round 1: The customer, a European manufacturer of automotive spare parts, has seen a drop in profit in recent years and doesn't understand why. He calls on you to help him understand why his profit has fallen, and to find solutions that can be implemented to improve the situation.

Growth case studies: a favorite topic for strategy consultants

A growth case is a very stimulating one, since the client company is primarily looking to increase its sales and thus grow. It's the most obvious issue for any company, but not the easiest to tackle. Growth issues are extremely wide-ranging, and include almost all other approach structures. The challenge, therefore, is to quickly identify the levers that can be used, while at the same time scanning the full range of possibilities. There are a thousand ways to grow, and it's up to you to find the one best suited to your company! Three things you need to know about these case studies:

- Don't talk about costs, you'll be off-topic. Growth is a topline topic.

- The sources of organic growth are to follow market growth or to stimulate one's own growth.

- External growth is achieved through the acquisition of another company.

Example - Case study Bain 2nd tour : Our customer is a player in the contract catering sector. It orders raw materials, then receives them, cooks them and finally serves them. It has 3 types of customer: companies, schools and healthcare establishments (hospitals/clinics, retirement homes). The new CEO has observed slow sales growth of 0.5% per year. He is calling on you to increase this growth to 5% within 3 to 4 years.

Case studies of new market entry and new product launches

Cases of entry into a new market arise when a customer already has an existing product in a given geography which is working a priori well, and is looking to expand into new horizons. New market" can mean two things, and should be clarified in the clarification questions if it is not clear from thecase study statement.

- Entry into a new location, be it a region or a country

- Launch of a new product to diversify its range in existing geographies

Example - McKinsey case study Round 1: Our client is a real estate company that owns and operates luxury hotels worldwide. It already has three resorts in Dubai and is planning to build a fourth, in another Middle Eastern country, specifically for the wealthy. It's calling on you to find out if this is a good idea, and if so, how to go about it.

Pricing case studies: rarely a case in itself, but important to know

Pricing cases arise when a customer has a product or service that has not yet been launched on the market, and is looking to set a price for it. Pricing issues are not usually the subject of a case study in their own right, but are often integrated into broader case studies. Pricing issues are crucial for companies. They often call on consulting firms to answer them, because most of the time they have no idea what the market prices are, what margins are possible on these types of product, or what future customers' willingness to pay is. To best tackle these cases, you need to know that there are 3 key steps to determining a price:

- Calculate a price range by studying competitors' prices.

- Calculate a minimum price based on the cost of the product or service.

- Calculate a maximum price based on consumers' willingness to pay.

Example - Oliver Wyman case study Round 1: Our client is an electricity supplier in France who wants to launch a new product: a smartbox that will enable its customers to consume 30% less electricity. He is calling on you to determine at what price to launch this product and to estimate its level of profitability within 2 years.

M&A and Private Equity case studies: from investment banking to strategy consulting

M&A and Private Equity cases are those where a company is considering whether or not to buy or merge with another company, or where an investment fund is considering whether or not to invest in a company. Typically, this involves a quantitative analysis of the target company's financial situation, complemented by a qualitative analysis of related interests.

- M& A: The qualitative part is just as important as the financial part, because the cultural and organizational integration of two companies is extremely sensitive.

- Private Equity: Predominance of the financial part, since investment funds generally have precise objectives in terms of return on investment over a defined time horizon.

M&A example - BCG case study 2nd round : Our client is an English-speaking soccer club which wants to invest in a new soccer club in Asia to boost its visibility, as it has noticed that it is not very attractive in this region. The purchase price of the Asian club is €200 million. Is it a good idea to buy it?

Private Equity Example - Roland Berger Case Study Round 1 : Our client is a mid-cap investment fund. It is interested in the baby incubator market. They want to know the market's growth prospects and whether it's a good idea to invest in it.

Case studies in response to competition: a complex case not often seen in the 1st rounds

In the final rounds, more complex case studies will be proposed. The cases that interviewers particularly like to ask about at this stage are those involving a response to competition or a response to a new entrant. These are highly strategic case studies in which a player is challenged in its traditional business and the whole structure of the sector is called into question. This could be, for example, because an existing competitor or a new entrant is proposing a new, more effective product. In this type of case study, the best way to deal with the threat is as follows.

- Assess the strategic, financial and operational consequences.

- Establish one or more response strategies.

Example - McKinsey case study Round 1: The beverage department of a regional supermarket network in the United States saw its sales decline over the previous year. A new player has arrived in the region. They are calling on you to assess the medium-term consequences of this new threat and how to improve the situation.

Out-of-the-box case studies: extremely rare, but don't be surprised!

The out-of-the-box category refers to case studies that cannot be classified in the other case families because of their specific features. This type of case will test your ability to adapt and step out of your comfort zone. They can be totally specific case studies, or public-sector-type case studies which rarely fall into this category. As a reminder, public sector assignments represent less than 10% of the assignments undertaken by strategy consulting firms. Find out more in our article on strategy consulting.

Example - BCG case study Round 2 : Vale is a Brazilian multinational metals and mining company, and the world's largest producer of iron ore and nickel. A few weeks ago, Vale won a tender to operate a mine in Manaus in the Amazon, and during the exploration phase, a team of engineers discovered a dinosaur. The company called in BCG Sao Paulo to find out what it could do with it?

Now that you know everything there is to know about business case studies, here's the key information on market research case studies.

Market research case studies in strategy consulting interviews

Market sizing: an essential test in the strategy consulting recruitment process

Market sizings are a recurrent feature of strategy consulting interviews. They can be the subject of a separate case study, typically in the 1st round, or integrated into a business case study. The objective is always the same: to test your analytical skills and the structure of your approach to problems. It's usually a matter of estimating the size of a market, in a few minutes, or a company's turnover. The most important thing is to have logical reasoning based on hypotheses. The method of resolution is therefore more important than the final result.

In 5 steps you can solve all market sizings:

- Ask the right clarifying questions

- Building your approach structure

- Quantifying assumptions

- Solving calculations

- Conclude with a step back

To find out more, read our article on how to succeed in this exercise: Market sizing in 5 steps

Example - Market Sizing Roland Berger 1st round : Our client is an investment fund that owns a swimming pool equipment company. They want to sell it, so they ask Roland Berger for help with due diligence. As a junior consultant, you'll be in charge of the market study: size, value, volume and growth. How do you go about it?

Brain-teaser: very rare in strategy consulting, but worth knowing

A brain-teaser is an enigma in the form of a complex question or problem. The aim of this type of interviewcase study is not really to get the correct answer, but rather to assess the candidate's thought process, ability to approach difficult problems, to be structured and to find creative solutions. Interviewers also use these questions to assess the candidate's responsiveness and adaptability, much like out-of-the-box case studies.

Example - Brain Teaser: Which way do you install three escalators in a metro station?

In a few words, master the different case studies, then practice as much as you can.

Knowing allthese case studies is essential. In particular, learn the frameworks corresponding to each type of case study, whichyou can find here in our e-learning area. Once you're familiar with them, work on them to get the most out of them, and try to detach yourself from them to be more case-specific. Finally, practice as much as you can! Practice is the key to preparing for strategy consulting interviews. So get practicing, whether with professionals or friends! Take a training session with our MBB consultants or take part in the Prépastrat bootcamp to boost your preparation.

Would you like to become an expert in case studies?

Then join us and be part of the 90% of our candidates who integrate a TOP 6 every year. PrepaStrat is the first interview preparation program for strategy consulting firms, with :

- 7 years of expertise, we're the oldest player in strategy consulting interview preparation

- 6 bootcamps per year, comprising 35 hours of training over 5 days

- 1 referent coach from an MBB for each supported candidate

- 100% of our coaches are Senior Consultants and Managers from McKinsey, BCG and Bain

- 6 online training modules to prepare you for interviews and understand what strategy consulting is all about

- 50+ corrected case studies that have already fallen into the hands of top strategy consulting firms

- Aim for excellence and join the top strategy consulting firms with PrepaStrat

Discover our bootcampour real-life interviews and our e-learning platform !