Market sizing is an essential part of the recruitment process for strategy consulting firms. In just a few minutes, the market sizing exercise enables your interviewer to assess your analytical skills and reasoning capacity. Often, it's a question of determining the size of a market, in terms of volume or value, based on very little information. But remember, an interviewer can ask you to estimate anything. For example, you may be familiar with the legend of market sizing: "How many golf balls are needed to fill an Airbus A380?" Disconcerting, isn't it? The good news is that there's a single method for solving any type of market sizing.

Find out in this article how to excel in this exercise and shine in your strategy consulting interviews.

What is market sizing?

Market sizing, a test of reasoning

Market sizing generally consists of estimating the size of a market in terms of volume or value, in order to answer a specific question. For example, a market sizing question might be "What is the market size of telecom operators in France? Don't panic, the interviewer won't expect an exact answer from you. On the contrary, he'll be looking for logical reasoning based on hypotheses. The two objectives of market sizing are to measure your ability to structure your thoughts and your ability to calculate. If you achieve these two objectives, your result will naturally be in the right order of magnitude. In short, the method of resolution is more important than the final result.

Two distinct forms of market sizing: flash test or standalone exercise

Market sizing during your interview can take two different forms as :

- First question of a case: the ultimate flash test

- Standalone exercise: a case study in its own right

When market sizing is asked at the start of a case study, the aim is to calculate a key piece of data for the rest of the case, putting your calculation and hypothesis formulation skills to the test. As this is not the core of the case study, you are generally expected to solve the exercise quickly, in just 5 minutes.

When used as a stand-alone exercise, market sizing is a case in itself. Not only does it test your problem-solving skills, it also shows how far you can go in your assumptions. You need to demonstrate your mental agility and ability to make quick calculations while establishing precise hypotheses based on your business-sense. As a stand-alone exercise, market sizing can take between 20 and 30 minutes.

See also: Passing the strategic consulting case study test

Market sizings in volume or value

The last thing you need to know about market sizings, before tackling the methods of resolution, is the unit to be used. Market size can be calculated in terms of volume or value. The best thing to do is to always ask the interviewer at the outset whether you're looking for market size in volume or in value, although generally it will be in value, i.e. both.

- Market volume refers to the physical quantity of units of a product or service over a given period.

- Example: in the case of telecom operators, the market volume could be the sum of Internet and telephone subscriptions in France, excluding equipment sold by operators.

- Market value refers to the total sales generated by the sale of units of the product or service. It is calculated by multiplying the unit price by the market volume.

- Example: in the case of telecom operators, the market value would be the total sales generated by the sale of Internet and telephone subscriptions, excluding equipment sold by the operators.

Now that you know what market sizing is, let's find out how to solve all types of market sizing, without exception.

5 steps to resolving market sizing

1. Questions of clarification: applying ROLS

The first step is crucial to getting your market sizing off to a good start. With the ROLS methodology, you leave no question out and frame the exercise from the outset, showing your interviewer your ability to use a structured approach.

- Summary: rephrase the case statement to show that you've taken note of everything and to clarify each term

- Objectives: determine whether market sizing should be estimated in terms of value (number of units) or volume.

- Location: define the spatial perimeter of the case: in France or worldwide?

- Strategy: Do we value this market over the year? Is it an individual or collective asset? Etc.

To set yourself apart even more when applying ROLS, we advise you to make suggestions to your interviewer every time, rather than leaving the choice to him or her. In other words, be proactive! For example, for market sizing on telecom operators, this would give :

- R. Okay, so if I've understood correctly, we're looking to evaluate the telecom operator market.

- O. I suppose it's in terms of value that we're trying to determine it? Do we take into account both subscription services and equipment products?

- L. Very well, on a French scale?

- S. And over a year?

After the ROLS, take a few moments to draw up your approach structure on your sheet of paper.

2. The market sizing approach: a determining factor in your exercise

Before building your market sizing equation, you need to ask yourself what approach you're going to use, as this will determine how you define your assumptions. You'll need to choose between a supply-side or demand-side approach, then between a top-down or bottom-up approach.

Supply or demand will determine the equation you use to calculate your market sizing, bearing in mind that sometimes you'll need to calculate both supply and demand to find the final solution.

- Supply: you need to determine the market's capacity to produce the units sold, which will depend on the number of suppliers and their production capacity.

- Example: for telecom operator market size, determine the number of operators and their coverage capacity in France.

- Demand: you need to determine the market's consumer demand, starting with the population or individuals.

- Example: for the market size of telecom operators, use the size of the French population, the number of homes or an individual directly to determine the number of subscriptions and the average shopping basket.

Instead, the top-down or bottom-up approach allows you to determine the direction in which you will detail your hypotheses to arrive at the final result.

- Top-down: start with broad hypotheses and refine them as your analysis progresses - this is the funnel method.

- Example: for the market size of telecom operators, use the size of the French population to determine the volume of telephone subscriptions, then determine the number of homes to calculate the volume of internet subscriptions.

- Bottom-up: in contrast to the top-down approach, you start with very precise hypotheses before generalizing.

- Example: to calculate the market size of telecom operators, start with the average individual subscription basket and the number of people per dwelling, then work up to the total French population.

Once you've determined your approach structure, all you have to do is write down your equation.

- Market = Price x Volume

- Volume 1: number of homes x penetration rate -> internet, fixed-line, tv

- Volume 2: number of people x penetration rate -> telephones

- Price: average price of an Internet subscription for homes and average price of a telephone subscription for telephones.

Form is just as important as content. You should have a sheet of paper in landscape format on which you'll write the market sizing statement and the information gathered during the ROLS. At the top of the sheet, write your market sizing equation, then use the remaining space for the hypotheses you're going to detail. Finally, we recommend that you take a separate sheet of paper for your calculations.

Once you've worked out your approach structure, you need to say it out loud to your interviewer and ask him or her if he or she is comfortable with it. Each time, explain your reasoning and your choices so that they understand your approach. If your structure is validated, congratulations, you can move on to quantifying your hypotheses.

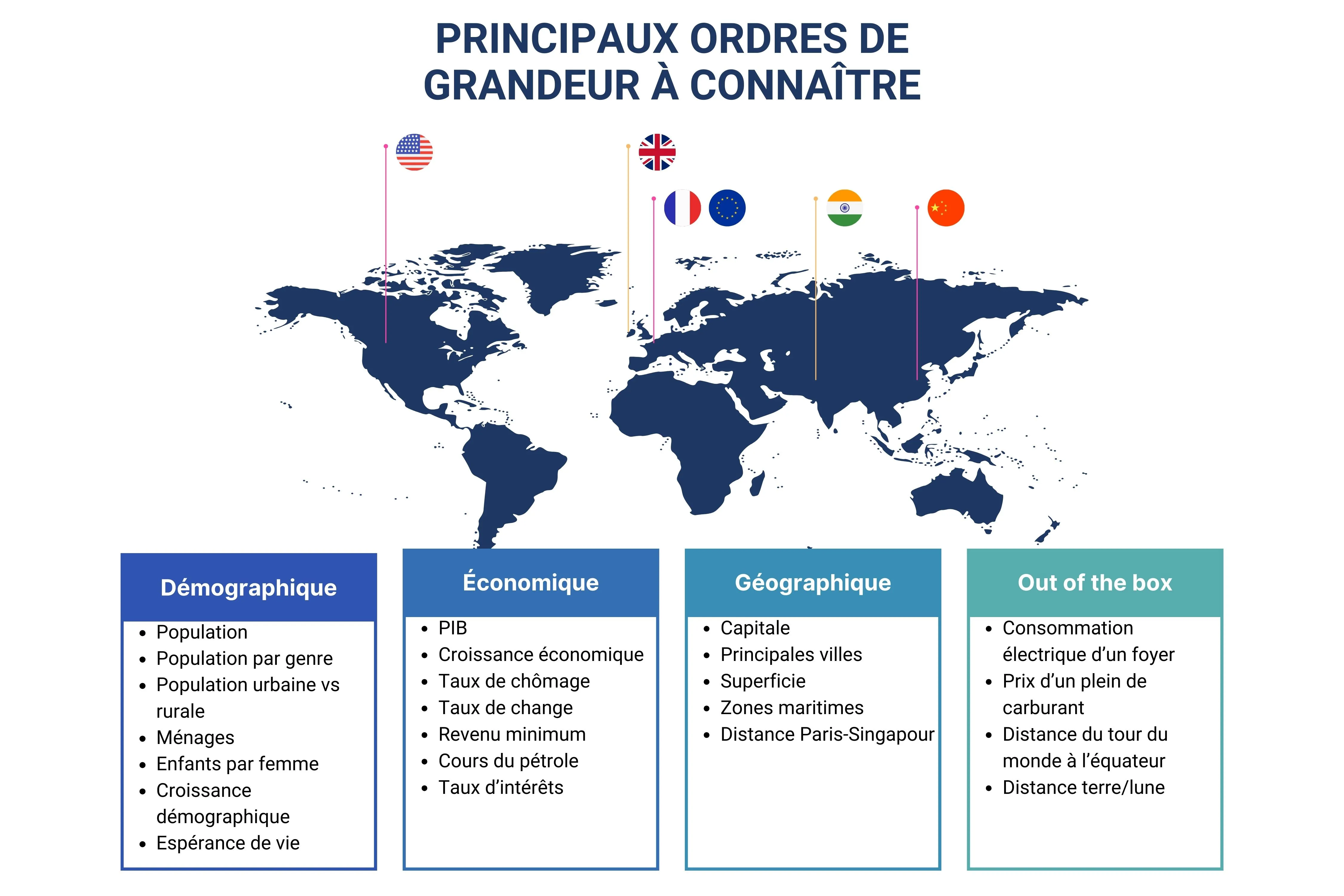

3. Quantifying market sizing assumptions: orders of magnitude to be aware of

Normally, if you arrive at the quantification stage with your structure validated, you've almost done the hard part. All that remains now is to quantify your hypotheses and make the calculations. And in this exercise, the interviewer must be your best friend! For quantification, you need to know the main orders of magnitude for France, Europe and the main regions of the world: population, number of households, GDP, unemployment rate and life expectancy. For the rest, use the following 2 methods to quantify your assumptions:

- Personal experience : in the case of chewing gum, for example, use your own consumption or that of your friends as a basis for hypotheses.

- Benchmark: look at other sectors or other geographies. Again, in the case of chewing gum, if you don't consume it, start from your consumption of tic-tac or candy.

If you really don't know, use your interviewer to move forward, and don't get stuck. There's nothing wrong with not having certain information. Indeed, when you're a strategy consultant you won't be able to know everything and your biggest source of information will be other consultants, and ChatGpt ☺

4. Solving market sizing calculations: watch out for the pitfalls!

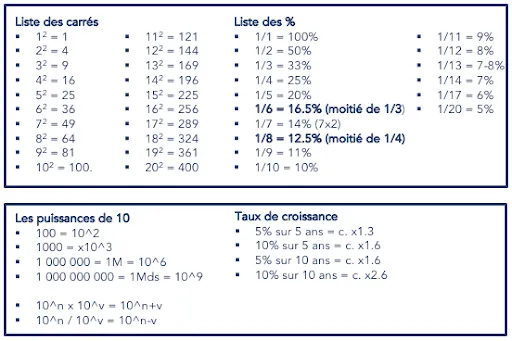

Take your time to avoid costly mistakes. The calculations involved in market sizings are usually multiplication and sometimes division - nothing too difficult. But when you're under stress, it's easy to make silly mistakes, which is why you absolutely must take your time. Here are a few tips:

- Round off your figures as soon as possible to make your calculations easier.

- Calculate with powers of 10 to avoid making errors of 0

- Memorize your % from 1/1 = 100% to 1/20 = 5%.

- Practice your calculations as much as possible

You can solve your calculations out loud or without speaking - both are possible. If you prefer to do them without speaking, don't hesitate to give intermediate results so that your interviewer can follow you in case you make a mistake. This will also help you to avoid those long moments of silence when your interviewer may lose interest in your market sizing by answering a text message or an e-mail.

5. Market sizing: be among the best candidates!

The conclusion serves to verify your result, put it into perspective, take a step back by adding a sensitivity and make an opening.

- Check the result with a sanity check: ask yourself if the figure is consistent. For example, for the size of the chewing gum market in France, a market of over €1 billion would be strange, so check your orders of magnitude.

- Put into perspective: put your results into perspective with other elements. For example, for the size of the chewing gum market in France, relate it to the population to obtain the average consumption per individual.

- Take a step back: you have just found a precise result with untested hypotheses. Take a step back from your reasoning by adding a sensitivity of -10/+10% to your result to say that the real size of the market lies within this range.

- Opening: if you feel like it, you can add a comment on the market you have just calculated. For example, for chew-gum in France, you can say whether you think this market will tend to grow or shrink and for what reasons.

All these elements will enable you to stand out from the other market sizing candidates by demonstrating your ability to reason in a structured and logical way, while taking a step back from your work.

Market sizing: 3 tips to help you get ready

1. Interacting with your interviewer

There's more to market sizing than putting a problem into equations and solving calculations. It's essential to maintain a dialogue with your interviewer throughout the exercise:

- ROLS: to proactively frame market sizing and make sure you've understood what you're being asked to do.

- Approach structure: to validate the approach you're using, by supply or demand, top-down or bottom-up, to make sure you're going in the right direction.

- Quantification: to check your hypotheses and get the right orders of magnitude if you don't have the figures in your head.

- Calculations: check your calculations at intermediate results to avoid continuing to run your equation with the wrong results.

- Conclusion: to put your result into perspective and conclude with the interviewer that you're on the right scale.

The best way to keep an interviewer involved and connected throughout the interview is to keep the two of you interacting. Don't forget this during your training sessions!

2. Practice your calculations

Calculations are supposed to be the easiest part of market sizing, which is above all a test of reasoning. However, many candidates lose their nerve through lack of practice. Brush up on your mathematics and calculations, then memorize the above rules.

As a bonus, if the interviewer asks you to estimate the market size over the next few years, assuming that it's a growing market, remember the growth rate rules above.

3. Make the most of market sizings

There's no secret about it: to become an expert in market sizing, you need to practice a lot. The advantage over a case study is that you can practice market sizing on your own and check your results on the Internet. Vary the market sizing you practice on, deepen your reasoning, get faster and faster without making calculation errors, and put your results into perspective. Eventually, you'll become an expert!

Practice market sizing with our experienced consultants from McKinsey, BCG and Bain

Want to become a Market Sizing expert?

Then join us and be part of the 90% of our candidates who integrate a TOP 6 every year. PrepaStrat is the first interview preparation program for strategy consulting firms, with :

- 7 years of expertise, we're the oldest player in strategy consulting interview preparation

- 6 bootcamps per year, comprising 35 hours of training over 5 days

- 1 referent coach from an MBB for each supported candidate

- 100% of our coaches are Senior Consultants and Managers from McKinsey, BCG and Bain

- 6 online training modules to prepare you for interviews and understand what Strategy Consulting is all about

- 50+ corrected case studies that have already fallen into the hands of top strategy consulting firms

- Aim for excellence and join the top strategy consulting firms with PrepaStrat

Discover our bootcampour real-life interviews and our e-learning platform !